XRP Price Prediction: Will It Break Through $3 Amid Mixed Market Signals?

#XRP

- Technical Resistance: The 20-day moving average at $3.0346 presents immediate resistance that must be broken for sustained upward movement

- Fundamental Support: Institutional adoption through banking partnerships and ETF speculation provides strong underlying support for price appreciation

- Market Sentiment: Mixed news flow requires careful monitoring of both bullish catalysts and bearish warnings from seasoned traders

XRP Price Prediction

Technical Analysis: XRP Approaches Key Resistance Level

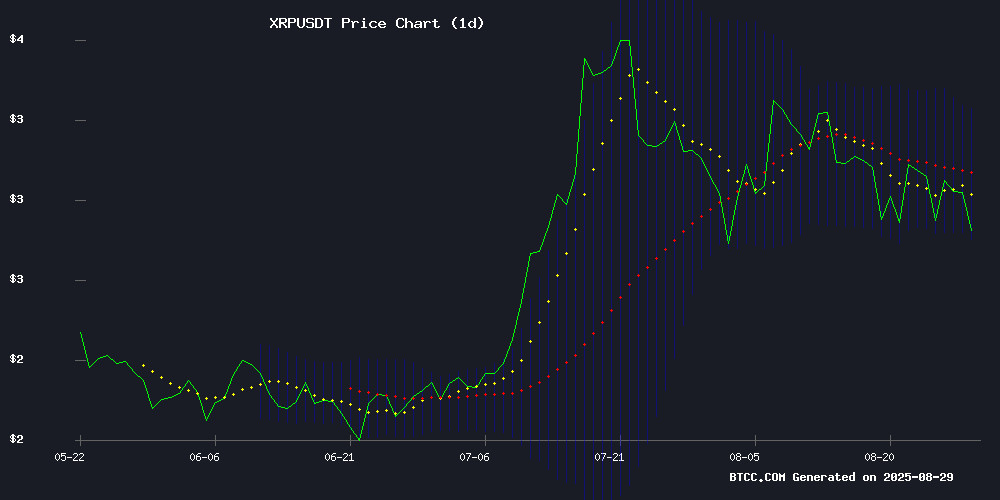

XRP is currently trading at $2.8031, positioned below the 20-day moving average of $3.0346, indicating potential short-term resistance. The MACD reading of 0.1402 versus 0.1021 shows bullish momentum building, though the signal line remains positive at 0.0381. Bollinger Bands suggest the asset is trading NEAR the lower band at $2.7805, with the middle band at $3.0346 and upper band at $3.2888 providing clear resistance targets. According to BTCC financial analyst Michael, 'The technical setup suggests XRP is consolidating before a potential breakout attempt toward the $3 level, though sustained momentum above the 20-day MA will be crucial for bullish confirmation.'

Market Sentiment: Mixed Signals Amid Fundamental Developments

Recent news flow presents a complex picture for XRP. Positive developments include VivoPower's expanded partnership with Crypto.com offering XRP incentives, Brazil's Braza Bank processing $1 billion in stablecoin payments on XRP Ledger, and ongoing ETF speculation providing upward momentum. However, seasoned trader Peter Brandt's bearish warning and the U.S. government's selection of chainlink over XRP Ledger for economic data create headwinds. BTCC financial analyst Michael notes, 'While whale activity and institutional adoption provide strong fundamental support, traders should remain cautious of mixed signals and monitor the $3 psychological level closely for breakthrough confirmation.'

Factors Influencing XRP's Price

VivoPower Expands Crypto.com Partnership with XRP Incentives for Shareholders

VivoPower International PLC has deepened its collaboration with Crypto.com, introducing a $100 XRP bonus for shareholders who register through a designated affiliate link. The initiative underscores the company's strategic pivot toward digital asset integration, with Crypto.com serving as the official custodian for VivoPower's XRP holdings.

The program, limited by token availability, aligns with VivoPower's broader ambition to lead in decentralized finance. Shareholders gain exposure to XRP's ecosystem while the firm reinforces its treasury management strategy. This follows an August 2025 agreement between the parties for digital asset custody services.

XRP Holders Poised for Gains Amid EU-US Trade Policy Shifts

The European Union's potential removal of tariffs on US industrial goods could trigger a liquidity surge benefiting digital assets. Market analyst Levi Rietveld identifies XRP as a prime beneficiary of this macroeconomic shift, citing increased capital availability and retail investor interest.

Lower trade barriers coincide with anticipated rate cuts, creating ideal conditions for alternative asset growth. Rietveld's analysis suggests XRP may lead cryptocurrency market gains in coming months as capital seeks high-growth opportunities beyond traditional markets.

Seasoned Trader Peter Brandt Issues Warning on XRP's Bearish Potential

Veteran trader Peter Brandt, with five decades of market experience, has turned his analytical lens toward the cryptocurrency sector, delivering a sobering assessment of Ripple's XRP. His latest technical analysis suggests the asset may be forming a concerning pattern, prompting a cautionary note for investors.

The chart structure shows deterioration, with lower highs signaling waning bullish momentum. Brandt's trademark objectivity remains intact despite his historical skepticism toward cryptocurrencies. "I share what I see," he stated, acknowledging his own fallibility while emphasizing the chart's concerning signals. The $2.78 support level now becomes critical, with $2.39 acting as a secondary threshold.

Market participants are weighing this technical warning against potential catalysts, including anticipated ETF approvals that could reinvigorate the sector before year-end. The analysis comes weeks after Brandt identified a head-and-shoulders formation in March, demonstrating his continued scrutiny of crypto assets despite maintaining professional distance.

Brazil’s Braza Bank Processes $1B in Stablecoin Payments on XRP Ledger

Braza Bank, a Brazilian financial institution, has reportedly completed $1 billion in stablecoin payments using its BBRL token on the XRP Ledger (XRPL) during Q3 2025. The milestone underscores growing institutional adoption of blockchain-based solutions for cross-border transactions.

The BBRL stablecoin, pegged to the Brazilian Real, is part of Braza Group's strategy to bridge traditional finance with decentralized infrastructure. Earlier this year, the bank expanded its offerings with USDB, a dollar-pegged stablecoin backed by U.S. and Brazilian government bonds.

Ripple's May 2025 statement corroborates the scale of adoption, noting Braza processed $1.079 billion in a single day this April. The XRPL's architecture provides the bank with a scalable framework for settlements and mass payouts.

Analyst Predicts Imminent XRP Breakout Despite Market Weakness

XRP's long-term chart structure suggests an impending moonshot, according to technical analyst Matt Hughes. The cryptocurrency has consistently converted former resistance levels into support zones, with the $3.00 psychological level now acting as a firm base. Current trading at $2.86 follows a recent test of $3.66, indicating building momentum.

Historical patterns reveal a significant shift: the $0.50-$1.00 range that once capped XRP's movements has been decisively broken, with the asset maintaining position above 2021's $1.96 peak for weeks. Gann Fan analysis shows diagonal resistance lines from 2018 and 2021 peaks have transformed into reliable support levels.

"This isn't speculation—it's chart reading," Hughes emphasizes, pointing to XRP's ability to quickly reclaim key levels after brief dips. The asset now faces what traders call the "final boss" level—a decisive breakout threshold that could trigger the next major rally.

U.S. Government Selects Chainlink Over XRP Ledger for On-Chain Economic Data

The U.S. Department of Commerce has opted to integrate Chainlink's oracle network—rather than the XRP Ledger—for broadcasting macroeconomic data on-chain. The decision underscores a functional divide between the two protocols: XRP specializes in cross-border value transfer, while Chainlink serves as a bridge for real-world data to smart contracts.

Chainlink's chain-agnostic design proved critical for the government's need to disseminate indicators like GDP and inflation across multiple blockchains. The collaboration focuses solely on data reliability, not payments—a nuance that left some XRP proponents disappointed despite the networks' non-competing use cases.

Open Miner XRP Cloud Mining Emerges as Top Free Crypto Mining Solution for 2025

Amidst persistent market volatility and tightening regulations, Open Miner has positioned itself as a leader in cloud-based cryptocurrency mining. The platform's XRP-focused offering combines environmental sustainability with accessibility, enabling users to generate passive income without the hardware burdens of traditional mining operations.

The service leverages remote data center infrastructure to eliminate capital-intensive setups. Users simply select from optimized contract plans, with automated computing power allocation and daily profit distributions to digital wallets. "This represents the democratization of crypto wealth generation," notes an industry observer, highlighting the platform's $500 sign-up incentive and $1 daily login rewards.

XRP Whale Activity Sparks Optimism for $10 Price Target by September 2025

XRP has re-emerged as a focal point in crypto markets, with its price stabilizing near $3 amid bullish projections of a potential surge beyond $10 within the next two years. The optimism stems from heightened accumulation by large-scale investors—a historical precursor to volatile price movements.

Separately, SolMining's cloud mining platform now accepts XRP payments, offering daily yield generation. Contracts range from $100 investments yielding $3.50 daily to $5,000 commitments generating $77.50 per day. The platform automates payouts, though such high-yield products carry inherent risks.

XRP Price Poised for Breakout Amid ETF Speculation

XRP's price action reveals a tightening pennant formation, a classic indicator of impending volatility. The digital asset currently tests critical resistance at $3.10, with technical analysts eyeing $3.37 and $3.60 as subsequent targets should bullish momentum prevail.

Market participants await regulatory clarity as the SEC extends its review period for proposed XRP ETFs. Dom Kwok of EasyA suggests approval could unlock substantial institutional capital, potentially propelling prices beyond $4.00. The Directional Movement Index reinforces this outlook, showing strengthening positive momentum.

Support holds firm near $2.87, though failure to maintain this level may trigger a retest of $2.70. Traders monitor the narrowing price range with heightened anticipation, recognizing pennant patterns often precede decisive moves.

Will XRP Price Hit 3?

Based on current technical indicators and market developments, XRP shows potential to reach $3 but faces significant resistance. The price currently sits at $2.8031, approximately 7% below the $3 target. Technical analysis reveals the 20-day moving average at $3.0346 acting as immediate resistance, while Bollinger Bands indicate the upper band at $3.2888. The MACD shows bullish momentum building at 0.1402.

| Indicator | Current Value | Significance for $3 Target |

|---|---|---|

| Current Price | $2.8031 | 7% below target |

| 20-Day MA | $3.0346 | Key resistance level |

| MACD | 0.1402 | Bullish momentum building |

| Bollinger Upper | $3.2888 | Potential extended target |

Fundamental factors including institutional adoption, whale activity, and ETF speculation provide support, but mixed news sentiment suggests cautious optimism. Breaking through the $3.0346 resistance will be crucial for sustained upward movement.